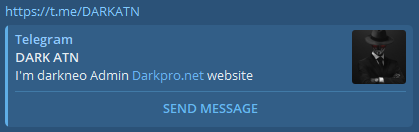

↤ 𝔻𝕒𝕣𝕜 ℕ𝕖𝕠 ↦

Admin, Carder, Hacker, Deepweb Seller

Staff member

Administrative

Moderating

Staff Member

Premium User

Forum Elite

Silvergate Stock Ascents as the Crypto Bank Holds Up in the Slump by crypto bank 2022

The monetary administrations bunch has situated itself as a "crypto bank" and detailed record total compensation in spite of an extreme drawdown in the computerized resource market.

Silvergate (ticker: SI) scored net gain of $38.6 million in the June quarter, conveying profit per share (EPS) of $1.13. Money Road had been expecting EPS of 84 pennies for the quarter, in light of the appraisals of examiners surveyed by FactSet . Net gain developed from $27.4 million in the earlier quarter and $20.9 million a year prior.

While development in the quantity of its advanced cash clients eased back somewhat, Silvergate kept on adding clients in this key fragment, arriving at 1,585 clients as of the finish of June, up from 1,503 as of the finish of Spring. Computerized cash client related expense pay tumbled to $8.8 million from $8.9 million in the earlier quarter and $11.3 million a year prior.

Normal computerized money client stores tumbled to $13.8 billion in the second quarter from $14.7 billion in the initial three months of 2022 in the midst of an emotional defeat that has hit crypto markets. Bitcoin just covered its most horrendously terrible quarter beginning around 2011 — a year where it crossed the $1 mark interestingly — and the all out market capitalization of the crypto space has tumbled to $1 trillion from almost $3 trillion eight months prior.

"Silvergate had one more solid quarter considering the difficult scenery confronting the more extensive computerized money biological system," Alan Path, Silvergate's leader and Chief, said in an explanation.

"Our foundation was worked to help our clients in this moderately beginning industry during times of high volumes, market unpredictability and change, and proceeded as planned all through the quarter," Path said.

The Silvergate Trade Organization, the bank's prompt interior bank move organization, took care of $191.3 billion in U.S. dollar moves in the three months to the furthest limit of June, up 34% from the earlier quarter.

The monetary administrations bunch has situated itself as a "crypto bank" and detailed record total compensation in spite of an extreme drawdown in the computerized resource market.

Silvergate (ticker: SI) scored net gain of $38.6 million in the June quarter, conveying profit per share (EPS) of $1.13. Money Road had been expecting EPS of 84 pennies for the quarter, in light of the appraisals of examiners surveyed by FactSet . Net gain developed from $27.4 million in the earlier quarter and $20.9 million a year prior.

While development in the quantity of its advanced cash clients eased back somewhat, Silvergate kept on adding clients in this key fragment, arriving at 1,585 clients as of the finish of June, up from 1,503 as of the finish of Spring. Computerized cash client related expense pay tumbled to $8.8 million from $8.9 million in the earlier quarter and $11.3 million a year prior.

Normal computerized money client stores tumbled to $13.8 billion in the second quarter from $14.7 billion in the initial three months of 2022 in the midst of an emotional defeat that has hit crypto markets. Bitcoin just covered its most horrendously terrible quarter beginning around 2011 — a year where it crossed the $1 mark interestingly — and the all out market capitalization of the crypto space has tumbled to $1 trillion from almost $3 trillion eight months prior.

"Silvergate had one more solid quarter considering the difficult scenery confronting the more extensive computerized money biological system," Alan Path, Silvergate's leader and Chief, said in an explanation.

"Our foundation was worked to help our clients in this moderately beginning industry during times of high volumes, market unpredictability and change, and proceeded as planned all through the quarter," Path said.

The Silvergate Trade Organization, the bank's prompt interior bank move organization, took care of $191.3 billion in U.S. dollar moves in the three months to the furthest limit of June, up 34% from the earlier quarter.